Although we should not be thinking about negative things and family tragedies, this does not mean that they cannot happen. Accidents or illnesses happen and sometimes at the most unexpected moments. This is why it is of great importance to be prepared for any eventuality or family emergency; Life insurance is the best option in these cases.

A life insurance offers economic support in the event of any eventuality or financial compensation to family members, in the event of the death of the insured. We know that the death of a family member cannot be replaced with money; however, having life insurance means taking care of your loved ones in one way or another. It is about leaving your relatives with financial support that will help them cope with the loss without having to deal with immediate debts and expenses.

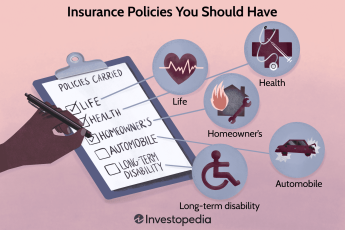

However, life insurance is not only for people who have a family life or it is only enjoyed in case of death; There are different insurance policies that can keep you protected according to your needs.

Insurance policies are also enjoyed in life; These have health coverage, hospitalization, disability policies, accidents, among others. There are also personal policies where you can choose the one that best suits you.

An insurance advisor is the right person to find all the detailed information and explanation of each of its clauses. Everything will depend on the type of policies you need.

If you request a family policy, each member of the family will be able to choose the policy that best suits each one of them.

The importance of having an insurance policy

Be insured against accidents at all times

Keep your relatives protected

Grant economic security to your relatives in case of death (compensation)

Compensation free of taxes and liens.

Disability policy

Advance policy for terminal illness.

Coverage of medical expenses and hospitalizations.

Facilities to pay.

Reasons why insurers deny payment of compensation

Reasons why insurers deny payment of compensation