Property insurance is a crucial aspect of protecting your valuable assets in the United States. Whether you own a home, rental property, or commercial real estate, having the right insurance coverage is essential. This blog post aims to provide you with valuable financial tips to navigate the world of property insurance effectively. By following these guidelines, you can ensure that you secure adequate coverage, save money, and protect your property from potential risks.

Understand Your Coverage Needs

Before purchasing property insurance, it’s essential to evaluate your coverage needs. Consider the value of your property, its location, and the potential risks it faces. For instance, if you live in an area prone to hurricanes, you might need additional coverage for windstorm damage. Assessing your needs will help you determine the appropriate level of coverage required to safeguard your property adequately.

Shop Around for the Best Rates

When it comes to property insurance, it pays to shop around. Different insurance providers offer various rates and coverage options. Obtain quotes from multiple insurers and compare them to find the best combination of coverage and affordability. Consider factors such as deductibles, limits, and exclusions while evaluating the quotes. Online comparison tools and insurance brokers can assist you in finding the most competitive rates.

Bundle Policies for Discounts

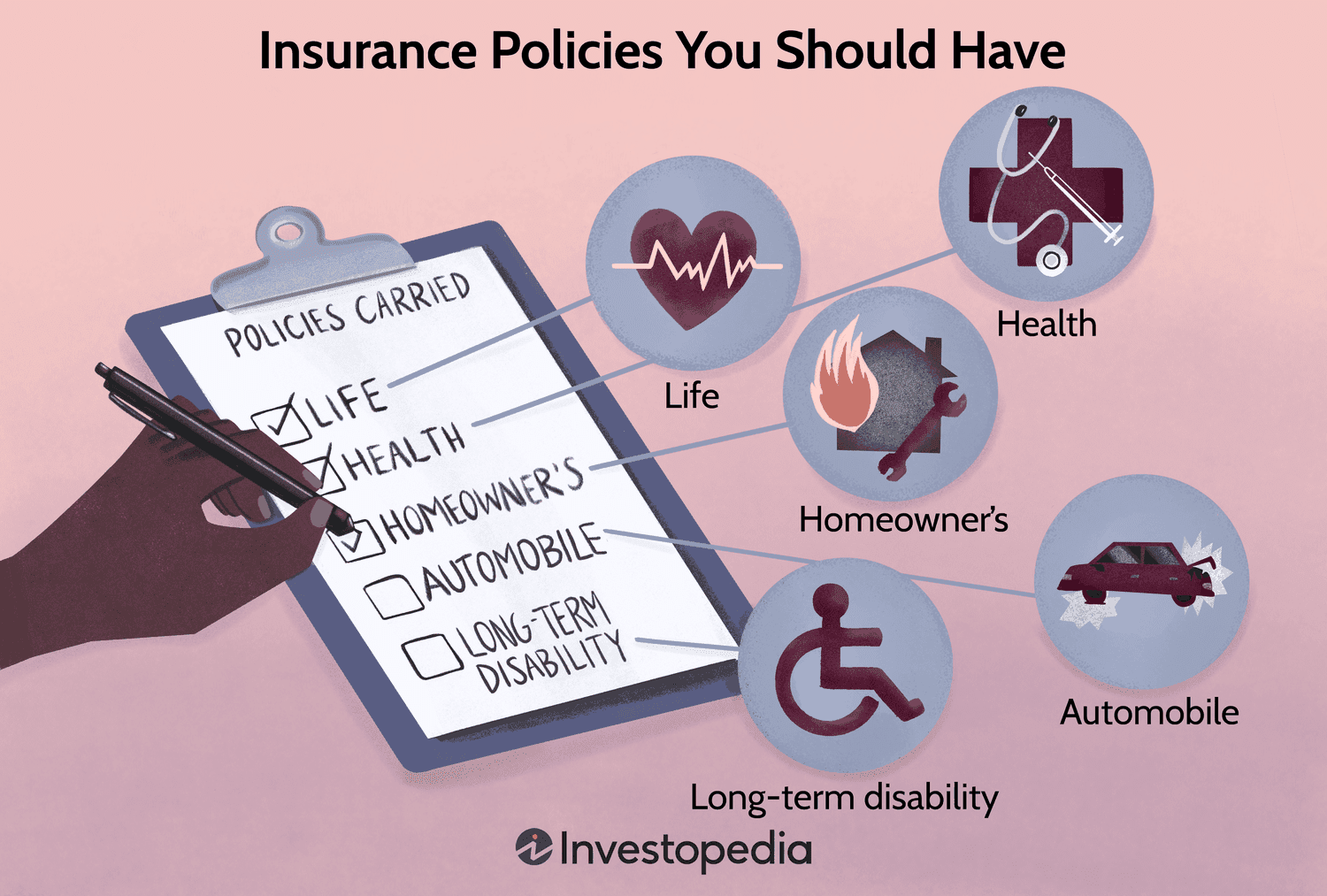

Insurers often provide discounts when you bundle multiple policies, such as property insurance and auto insurance, with the same company. Consolidating your insurance needs with one provider can lead to substantial savings. It’s worth exploring this option to take advantage of potential discounts and streamline your insurance management.

Maintain an Adequate Deductible

Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can help lower your insurance premiums. However, it’s crucial to strike a balance between a reasonable deductible and your ability to pay it in the event of a claim. Evaluate your financial situation and choose a deductible that aligns with your budget.

Regularly Review and Update Your Policy

As your property value changes or you make improvements, it’s crucial to review and update your insurance policy. Periodically assess your coverage to ensure it adequately reflects the current value and condition of your property. Failure to update your policy may result in being underinsured or paying for unnecessary coverage.

Mitigate Risks to Reduce Premiums

Insurance premiums are influenced by the level of risk associated with your property. Taking steps to mitigate risks can help lower your premiums. Installing security systems, smoke detectors, and sprinkler systems can make your property safer and potentially qualify you for discounts. Additionally, regular maintenance and upkeep can prevent losses and demonstrate your commitment to risk reduction.

The Best Property Insurance Package You Should Subscribe To

Dwelling Coverage

Personal Property Coverage

Liability Protection

Additional Living Expenses Coverage

Loss of Use Coverage

Optional Coverages

- Flood Insurance: Standard property insurance policies typically do not cover flood damage. If you live in a flood-prone area, consider adding flood insurance to your package for comprehensive protection.

- Earthquake Insurance: Similarly, earthquake coverage is not included in standard policies. If you reside in an earthquake-prone region, earthquake insurance can be a valuable addition to your package.

- Replacement Cost Coverage: This coverage ensures that your damaged or destroyed property is replaced with new items of similar quality, without factoring in depreciation. It provides better reimbursement for your belongings, offering peace of mind.

Conclusion

Securing the right property insurance coverage is a vital financial decision for property owners in the United States. By understanding your coverage needs, shopping around, bundling policies, maintaining an adequate deductible, regularly reviewing your policy, and mitigating risks, you can protect your property and achieve cost savings. Remember to consult with insurance professionals and take advantage of online tools to make informed decisions about your property insurance. Being proactive and well-informed will help you navigate the complex world of property insurance and safeguard your investments effectively.

Collection of unusual and huge cars of the UAE Sheikh Hamad bin Hamdan al Nahyan (28 photos)

Collection of unusual and huge cars of the UAE Sheikh Hamad bin Hamdan al Nahyan (28 photos)